Now Reading: Federal lawmakers unveil Tax Laws

-

01

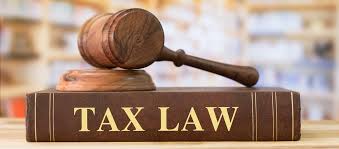

Federal lawmakers unveil Tax Laws

Federal lawmakers unveil Tax Laws

The implementation of new tax laws commenced yesterday on a clearer and more transparent footing.

The National Assembly directed the release of Certified True Copies (CTCs) of the harmonised bills that were transmitted by lawmakers and assented to by President Bola Ahmed Tinubu.

This move is aimed at ensuring full public access to the documents and allaying concerns about the authenticity of the recently passed Tax Acts.

The Clerk to the National Assembly, Kamoru Ogunlana, stated that interested members of the public would now be able to access the transmitted bills, which have been signed by President Tinubu, for independent verification.

In a statement, Ogunlana said the directive was in line with the Assembly’s commitment to transparency and accountability, particularly in response to public debate and scrutiny over the new tax reforms.

“The leadership has directed the Clerk to make available the transmitted Tax Bills duly signed by the President, including the certified pages, to enable members of the public independently verify the facts,” Ogunlana said.

He explained that the decision was taken following allegations of discrepancies between the Votes and Proceedings of the National Assembly and the gazetted versions of the Tax Acts currently in circulation.

Despite the intense public discussion generated by the new tax reforms, Ogunlana noted that only a limited number of Nigerians had formally requested CTCs of the harmonised bills.

“Only a few requests for Certified True Copies of the harmonised Bills have been received, and all such requests have been duly processed,” he said.

Ogunlana further explained that interested persons could still apply to the Office of the Clerk to the National Assembly upon payment of the prescribed fees.

He emphasised that the office of the Clerk was working closely with the Federal Government Printing Press (FGPP) to ensure the timely publication of the duly certified and assented laws.

Ogunlana said the gazetted copies were expected to be ready by yesterday.

“While the Clerk initiates the gazetting process, the statutory responsibility for printing and publication rests with the Federal Government Printing Press,” Ogunlana stated.

In the statement, signed on his behalf by the Director of Information, Bullah Audu Bi-Allah, Ogunlana said the National Assembly has introduced new procedural safeguards aimed at preventing future controversies over legislative documents.

He noted: “To strengthen institutional processes, all Bills for presidential assent will henceforth be routed through Presidential Liaison Officers.

“No request for gazetting an Act will be entertained by the Printing Press unless initiated by the Clerk to the National Assembly or an authorised representative.”

He reassured the public that the National Assembly remains committed to transparency, accountability, and professionalism in the discharge of its constitutional responsibilities.

The move comes as the Christian Association of Nigeria (CAN) called on the Federal Government to exercise wisdom, fairness, and restraint in implementing economic policies.

CAN President, Archbishop Daniel Okoh, emphasised in his New Year message that economic decisions must not exacerbate hardship for citizens already struggling to make ends meet.

“As fiscal, tax, and other policy reforms continue, CAN calls for wisdom, fairness, and restraint.

“As the nation continues to speak about reforms, recovery, and growth, CAN affirms that progress must translate into lived realities.

“Economic advancement must be evident in the daily lives of citizens – when food is affordable, healthcare is accessible, education is attainable, and meaningful work is available. Development that does not touch ordinary lives remains incomplete,” Okoh said.

Former President of the Chartered Institute of Taxation of Nigeria (CITN), Mrs Gladys Simplice, urged Nigerians to embrace the new tax regime.

She blamed opposition to the reforms on wealthy individuals resisting higher tax compliance.

Simplice said the biggest challenge confronting the reforms was not the law itself but a “mindset issue” among taxpayers.

She stressed that Nigerians must begin to see taxation as a civic responsibility rather than a burden.

According to her, sustainable national development depends largely on efficient tax collection.

“Taxes are what build nations. We cannot continue to complain about poor infrastructure and still resist the very instrument used to fix it,” Simplice said.

Highlighting the progressive nature of the reforms, she noted that low-income earners would benefit substantially, correcting historical inequities in Nigeria’s tax system.

“The reforms represent a major shift in the nation’s tax system by protecting low-income earners, who have historically carried a disproportionate share of the tax burden,” she said.

Simplice noted that globally, taxation is recognised as a key driver of development.

In Nigeria, however, the loudest criticism, she believes, comes from high-income earners who fear that the new laws will compel them to pay their true tax obligations.

“High-income earners are instigating others to attack the law because it will affect them.

“They have been avoiding their obligations for decades,” Simplice told the News Agency of Nigeria (NAN).

She emphasised that the reforms were long overdue and designed to promote fairness, support small businesses, and ease the burden on low-income Nigerians.

Under the new framework, individuals earning up to N300,000 annually are exempt from tax; small businesses with turnovers below N100 million will no longer face multiple taxation.

According to Simplice, this approach ensures equity and encourages compliance across all income levels.

She also highlighted the introduction of a self-assessment system, noting that improved data integration across federal and state governments would expose under-declaration.

“There is no hiding place anymore. You can assess yourself, but the government will still verify,” she said, citing Lagos State’s rollout of synchronised taxpayer identification numbers as a practical example of improved enforcement.

She urged Nigerians to give the reforms time to yield results, acknowledging that resistance to change is common but typically subsides once benefits become apparent.

AI tool launched

A technology expert, Oluwaferanmi Oladepo, has launched Kaanta, an Artificial Intelligence-driven tool designed to simplify the new tax reforms.

Kaanta, which operates entirely on WhatsApp, guides traders, small and medium-sized businesses, professionals, and individuals, helping them understand compliance requirements, calculate taxes, and access reliefs.

Oladepo said the AI tool allows users to interact via text, voice, or handwritten notes and supports local languages, including Yoruba, Igbo, Hausa, and Pidgin, expanding access to non-English speakers.

He stressed that Kaanta AI would play a critical role in helping Nigerians navigate the new tax era efficiently.

Source: The Nation