Now Reading: Federal revenue agencies face shake-up as Tinubu signs tax bills

-

01

Federal revenue agencies face shake-up as Tinubu signs tax bills

Federal revenue agencies face shake-up as Tinubu signs tax bills

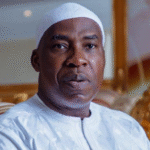

President Bola Tinubu on Thursday signed into law four tax reform bills, declaring that it signals Nigeria’s readiness for modern economic growth and international investment.

Following Tinubu’s assent to four tax reform bills, key revenue-generating agencies, including the Nigeria Customs Service, Nigerian Upstream Petroleum Regulatory Commission, and several federal ministries and agencies, may lose their tax collection mandates.

The development, which establishes the Nigeria Revenue Service as the sole body responsible for collecting federally chargeable taxes, is expected to trigger major restructuring across the federal revenue architecture.

“We have opened the door for new economic and business opportunities. We are showing that Nigeria is truly ready and open for business. Easy in, easy out,” said Tinubu at the signing ceremony held at the State House in Abuja.

The President acknowledged the complexities involved in tax reforms but praised stakeholders for demonstrating leadership and courage through the process.

Commending the collaborative effort behind the legislative process, he added, “What you have provided is leadership and courage in the face of mounting dispute. Nowhere in the world will tax reforms be any easier.”

According to him, the signing marks a turning point in the nation’s fiscal direction: “We are in transit. We have changed the rule. We have changed some of the misgivings. The question of our tax-to-GDP and all other formulas will be obsolete,” he said.

Thursday’s signing comes nearly two years after President Tinubu, on July 7, 2023, approved the establishment of a Presidential Committee on Fiscal Policy and Tax Reforms.

He appointed Mr Taiwo Oyedele, a Fiscal Policy Partner and Africa Tax Leader at PriceWaterhouseCoopers, as committee chairman. It came hours after he signed four Executive Orders, suspending the five per cent excise tax on telecommunication services and the excise duty escalation on locally manufactured vehicles.

The committee, inaugurated on August 8, 2023, comprised experts from both the private and public sectors. It was mandated to retrofit various aspects of tax law reform, fiscal policy design and coordination, harmonisation of taxes, and revenue administration.

On October 24, 2023, Oyedele presented a 30-day quick-wins report to President Tinubu, recommending the merger of over 200 taxes paid by Nigerian businesses into 10. In the months that followed, the committee undertook extensive engagements with stakeholders, culminating in the tax bills presented to the National Assembly in late 2024.

However, the bills faced resistance at the National Assembly and among some state governors, who rejected their passage. The Comptroller-General of the Nigeria Customs Service, Bashir Adeniyi, earlier said that the proposed tax reform bills are in jurisdictional conflict with the NCS and threaten the agency’s existence.

At the NASS, the bills sparked heated debate, particularly around the revenue-sharing structure, which governors from the North opposed. They warned that a shift toward derivation-based allocations, especially with VAT, could tilt fiscal balance in favour of southern states with stronger consumption bases.

After prolonged dialogue, the VAT rate remained at 7.5 per cent, and a new exemption was introduced to shield minimum wage earners from personal income tax. By May 2025, the National Assembly passed the harmonised versions with broad support, driven in part by pressure from economic stakeholders and international observers who welcomed the clarity and efficiency the reforms promised.

The four bills include the Nigeria Tax Bill (Fair Taxation), Nigeria Tax Administration Bill, Nigeria Revenue Service (Establishment) Bill, and the Joint Revenue Board (Establishment) Bill.

According to the President, “They will unify our fragmented tax system, eliminate wasteful duplications, cut red tape, restore investor confidence, and entrench transparency and coordination at every level.”

Tinubu added that the long-standing burden of Nigeria’s tax structure had unfairly weighed down the vulnerable while enabling inefficiency. Tinubu emphasised that the signing marks the beginning of Nigeria’s tax evolution.

Meanwhile, the Executive Chairman of the National Revenue Service (formerly the Federal Inland Revenue Service), Zacch Adedeji, has announced that the newly signed tax reform bills will take effect on January 1, 2026.

Adedeji, who briefed State House correspondents after Tinubu signed the four tax bills into law, said this would give the administration six months for planning, education, and alignment with the fiscal calendar.

He explained, “Based on best practices globally, because when you have this kind of change, it takes time for all the stakeholders, participant operators, and even the regulator to change the system. So with the magnanimity of the National Assembly, Mr. President, the effective date will be January 1, 2026, by the special grace of Almighty God.”

Adedeji stressed the importance of launching the reforms at the start of a new calendar year, saying, “When you have this kind of change, it’s not what you do mid-year. Because if the application of the law is better, you start from the beginning of the year.

“So effective dates, by God’s grace, will be first of January 2026,” he added. This timeline, the revenue chief explained, allows for adequate sensitisation, planning, and harmonisation with government budgeting frameworks.

For his part, the Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, Taiwo Oyedele, described the newly signed tax laws as “pro-poor,” saying they will ease the burden on low-income earners, small business owners, and everyday Nigerians.

He said, “More than 1/3 of workers in both the private and public sectors will now be exempted completely from PAYE. They will not have to pay personal income tax. Small businesses, over 90 per cent of small and micro, nano businesses, we no longer have to worry about paying corporate income tax or charging VAT or even deducting withholding tax or paying PAYE for their employees.”

Oyedele added that the reforms will leave “more money in the hands of the ordinary Nigerian to take care of their daily needs,” and announced a new zero‑rate VAT framework on essential items.

“Any traces of VAT in food, in education, in medical and health care are now removed completely, so we should see prices of those items come down,” Oyedele explained.

He also emphasised relief for sectors where households spend most, clarifying that “transportation, accommodation and housing is exempt from VAT… collectively account for more than 80 per cent of where Nigerians spend their money. That’s a huge relief for them.”

Appearing as a guest on Channels Television Politics Today programme on Thursday, Oyedele explained that the current system of revenue was opaque, noting that the new system, operated by the Nigerian Revenue Service will require the government to be more transparent and transparent.

“The current system is opaque. And usually, if you’re hiding stuff from me, I need to be suspicious of you. It’s hard to trust you if you’re not open and transparent. That’s exactly what we have today in Nigeria. So, these new laws require that government should be more transparent. There are requirements around the standard of reporting, the timeliness of those reporting, and making them accessible to the public, by the agencies like the Nigerian Revenue Service.

“(We’re changing) from FIRS to NRS, Nigerian Revenue Service. And that Nigerian Revenue Service will then work in collaboration with subnationals,” he said. The chairman explained that the NRS will operate a digitised system that will collect data like National Identity Numbers, phone numbers, and bank information, to prevent tax evasion by high-income individuals.

Oyedele emphasised that the new tax reform bills were designed with three principal objectives in mind, including ensuring that they were people-centric, efficiency-driven, and growth-focused.

Highlighting where revenue would come from, Oyedele said, “Two places where money would come from are tax evasion. We estimate that the tax gap, which is how much we are collecting and how much we could be collecting, is in the region of 70 per cent, so we are only collecting 30 per cent. We want to close that gap. Imagine if we just close it by another 30 per cent, that is double what we collect now.

“Number two is that we have lots of wasteful incentives. They are not just wasteful, they are also distortionary, so we lose money and create problems for the economy. So, we fixed that as well, so that’s money coming to the government without raising the tax on the people. Then there is the one to do with just ensuring that government resources are more effectively utilised. These areas combined will be where we will initially make money from.

“Ultimately, the money will come from the economy growing. If we get 10 per cent of $200bn, it is more than 100 per cent of one billion. That is where the money is coming from. It is not about going to the person who is trying to survive and asking them to give; they have nothing more to give.”

Source: Punch