Now Reading: FG directs FMBN to partners state governors on affordable housing projects

-

01

FG directs FMBN to partners state governors on affordable housing projects

FG directs FMBN to partners state governors on affordable housing projects

The Federal Government has directed the Federal Mortgage Bank of Nigeria to collaborate with state governors on developing bankable housing projects to bring homeownership solutions directly to citizens.

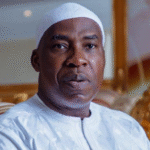

The Minister of Housing and Urban Development, Ahmed Dangiwa, gave the directive during the Federal Mortgage Bank of Nigeria Day at the 19th Africa International Housing Show in Abuja.

The News Agency of Nigeria reports that the Federal Government had earlier announced the Renewed Hope State-by-State Homeownership and Housing Development Campaign.

Dangiwa, represented by Mr Mark Chieshe, his Special Adviser, Media and Strategy, said the initiative is designed to bridge the gap between federal housing policy and state-level action, while taking homeownership solutions directly to citizens.

The collaboration, the minister said, is aimed at addressing the nation’s housing deficit by leveraging the expertise and resources of both the federal and state governments

He said FMBN remained the government’s strongest instrument for delivering affordable mortgage finance in Nigeria.

According to him, its mandate is clear, its recent progress is commendable, but the affordability challenge is far from solved.

“The biggest barrier to homeownership in Nigeria is not only the lack of adequate houses, but the inability of many Nigerians to afford them.

“While the government continues to address the supply gap, the reality is that even where housing units were available, their costs remained far beyond the reach of the majority of citizens,” he said.

Dangiwa said the affordability challenge needed to be confronted if Nigeria is to make meaningful progress towards delivering decent and affordable housing for all.

”I am directing FMBN to participate actively in this campaign, alongside other federal housing institutions.

“This is an opportunity for the Bank to showcase its products in every state of the federation.

“Work closely with governors to unlock land and structure bankable housing projects, embed technical support teams to help states design viable homeownership roadmaps,” he added.

Dangiwa also urged FMBN to bring the National Housing Fund products closer to contributors and eliminate the knowledge and access gaps that persist today.

Dangiwa said that the government would continue to support FMBN with policies, reforms and collaboration to ensure it fully realises its potential as the backbone of Nigeria’s affordable housing finance system.

Earlier, the Managing Director and Chief Executive Officer of FMBN, Mr Shehu Osidi, said the bank is the only institution that provides mortgages at a single digit, so it is the place to go for when hoping for home ownership.

Osidi, however, said that the most pressing challenge that continues to limit FMBN’s full potential is the issue of recapitalisation.

He explained that FMBN’s current paid-up capital of N2.5 billion is wholly inadequate for the size of its mandate.

He said that the figure, unchanged for decades, stands in sharp contrast to what is obtainable in similar institutions globally and even among commercial mortgage lenders in Nigeria.

He said that even Primary Mortgage Banks (PMBs), which operate at a much smaller scale than FMBN, have higher capital bases.

“It is to be noted that CBN’s minimum capital requirements for wholesale and retail Development Finance Institutions (DFls) are N100 billion and N10 billion, respectively.

“State and national primary mortgage banks, which are expected to rely on FMBN for funding, currently have minimum capital bases of N2.5 billion and N5 billion, respectively.

“Currently, the CBN has directed higher capital levels for banks as a way forward to growing a $1 trillion national economy,” he said.

Osidi said that the situation severely undermined FMBN’s ability to mobilise long-term finance from local and international markets/sources, among other factors.

“We cannot afford to run an institution with a national mandate on a local budget,” he said.

Osidi, the recapitalisation process would offer an opportunity to fundamentally reimagine the Bank’s business model to align with global best practices.

Source: Punch